I've incorporated Akagi's mentality to my gambling style, but I'm still not that great with it since I'm only wearing Akagi glasses, I don't have his eyes or brain.

What is gambling, but a meaningless death?

I've incorporated Akagi's mentality to my gambling style, but I'm still not that great with it since I'm only wearing Akagi glasses, I don't have his eyes or brain.

What is gambling, but a meaningless death?

Sanji: "Thanks… I needed a light."

After getting toasted by Enel.

it's kind of funny, last week we were facing the biggest economic crisis in history and then BOOM, the stock skyrockets!

Some of the biggest 1-day gains in the market were during the great depression.

@_Meh_:

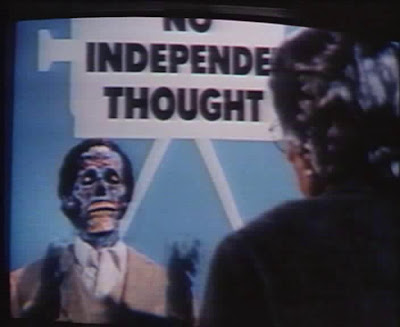

I'd settle for Roddy Piper in a pair of sunglasses.

Fuck yeah.

The only thing the government has to fund this is a printing press.

It won't be payed via. direct taxation, but rather through inflation.

So when you see the price of everything around you shooting up, you won't have to ask why. You'll already know it's everyone paying for the bailout plan and the Fed's easy money policies.

Peter Schiff on why the bailout is bad:

5_NhLRNsxFE

Is he brilliant, or merely a product of the old subscription scam?

Watch the videos I posted. Compare what he said in 2006 with the situation we find ourselves in now. Specifically the Mortgage Bankers Speech.

He was right, and for the exact reasons that he detailed.

I agree that the Fed is directly responsible for causing/delaying/hastening business cycles but you can't blame this crisis solely on it. The inevitable recession was amplified in severity due to the mortage meltdown and deficit spending which falls under the dominion of the Bush administration and Congress.

All these mortgages that melted down wouldn't have even existed if the Fed hadn't created all the excess credit to finance the thing. The problem here comes in when people blame individual mortgage lenders and people taking on teaser rate mortgages that they can't afford when the rates adjust as being the root of the problem. You cannot expect these people to act responsibly with money. Every bubble that has ever existed all throughout history is due to people being reckless with excess money and credit that the Fed created. As long as the excess credit doesn't exist then neither will the bubble, which eliminates the entire problem at the core.

Since the individuals will never be responsible with money, it's up to the Fed to tightly regulate the money supply so that there isn't so much going around that people will set up the next financial nuclear bomb bubble waiting to explode, which they have consistently failed to do, which is why we have artificial highs and massive market corrections (crashes/recessions/depressions). All the Fed has to do is quit with the easy money bullshit that finances these bubbles and it won't happen any more. Unfortunately the Fed is just as insane at issuing the credit as the people are at using it, which is why this is not the first time something like this has happened and certainly won't be the last.

It's not private corporations that create the business cycle, it's the Fed's reckless monetary actions that finance these huge monstrous bubbles that would have never existed in the first place under sane fiscal management. This sub prime disaster was another disaster created to bail out the dot com disaster which should have popped back in 2000 that the Fed itself also created via. excess credit. We're experiencing the compounding consequences of easy money policies. All the money has to go somewhere, which creates these megabubbles that generate huge sucking vortexes when they implode under the weight of their own unsustainability, as all bubbles inevitably do. The bailout will simply compound these consequences even further, making them even worse and the consequences more dire. All they're doing is trying to preserve and extend the bubble.

Sooner or later the piper is going to have to be paid. Better to pay it now rather than letting it compound until it drags the global economy to hell.

They are called malinvestments for a reason - there isn't anything to support them. They are inherently unsustainable and thus must be liquidated sooner or later. The longer we wait and the more the government and Fed try to interfere with the natural market correction, the worse the outcome.

It's like dealing with a morbidly obese person that eats too much and switching them from cheesecake to pie. There is absolutely no mechanism by which it could solve the problem. The only solution is to go on a strict diet. Yes, it will be painful, but better to suffer harsh consequences now than walk the path of absolute ruin later.

Without it, and hopefully more similar actions in the future, we're all fucked.

We're fucked anyway.

Total Fed Credit went up by another staggering $253.6 billion last week. A quarter of a trillion dollars in one week!

This is the magical stuff from which credit in the banks instantly appears, at the literal push of a button at the literal whim of the Federal Reserve, as the Fed makes all the money that the government wants to spend. And this credit in the banks is the miracle stuff from which money will be multiplied by the banks a hundred times over, a thousand times over, a million times over, all of it used to make new loans, all courtesy of the fraud known as fractional-reserve banking, which means that the Fed has, in the last two weeks alone, created over half a freaking trillion dollars' worth of new credit, which is turned into unknown trillions of dollars when the banks get finished multiplying it through insane degrees of fractional-reserve banking.

And it is not just American banks, either. The Federal Reserve, on behalf of the people of the United States, is giving hundreds of billions of dollars to foreign central banks to bail them out as well.

And then those selfsame foreign central banks used this money to buy $43 billion of U.S. government and agency debt last week.

This is insane.

The Federal Reserve, in case you did not realize it, is not federal, in that it is a private bank owned and it has no real reserves, but can create money anytime it likes, like last week, as the Fed created some money and then used the money to buy government bonds for itself. The Fed's stash of government bonds rose last week by $8.27 billion!

To show you that the Federal Reserve should instead be called the Government Slush Fund, the government borrowed most of this new money, as we realize when we see that Treasury Gross Public Debt went up by an eye-popping $336 billion last week, reaching the staggering total of $10.124 trillion.

In fact, in the last year alone, the national debt went up by $1.062 trillion! Gaah! We're freaking doomed! Not only is the federal budget a mind-blowing $3 trillion in the $14 trillion American economy, but the Congress is now spending an average of $88 billion per month more than the government's revenues, which is 30% more than what they budgeted! Insane, incompetent morons!

And all of this money created by the Federal Reserve - all those stupefying trillions and trillions of new dollars and credit - increases the money supply, which will increase prices in a persistent, grinding inflation, getting worse and worse, which will destroy America as it has destroyed every other idiotic country that tried such a recklessly insane and idiotic thing.

"Paper money eventually returns to its intrinsic value - zero."

- Voltaire

In other news, the Fed doubles its balance sheet instantly with one announcement, the creation of a $900 billion term auction facility. Honestly, if Bernanke has the balls to do this kind of stuff it really makes all that drama surrounding the Congress bailout bill look pretty trivial by comparison.

Here's what Peter Schiff, president of Euro Pacific Capital Inc and author of "Crash Proof: How to Profit From the Coming Economic Collapse" had to say on the subject back in 2006, which goes a long way in explaining this whole mess seeing as he successfully predicted it. This guy has an amazing track record of being bang-on.

Here's Peter predicting the US economic collapse with unbelievable accuracy:

LfascZSTU4o

Nov 2006 Mortgage Bankers Speech:

6G3Qefbt0n4 8hFmoTjljpw

qBk4PhdhCFQ xNKs8lBnd2U

MoSwkCog-Ro IrpPsOvHUU8

DVtT6spfffI xgRgGKxXbCw

Schiff on "Crash Proof":

6NvjrfC6i0I

I'd like to hear some arguments why this crisis isnt the result of business cycles, and why the government bailout is bad. Read my previous post.

to make it as simple as possible:

[qimg]http://welkerswikinomics.com/blog/wp-content/uploads/2008/01/businesscycle_1.jpeg[/qimg]

This is a simple business cycle. It is an inevitable part of free market economies.

The "business cycle" is created by the Fed and easy money. There's nothing natural about it.

Any move to stop a recession will backfire and make the problem much worse in the long run.

We should have had a recession after the dot com bubble. but thanks to 1% interest rates and subprime mortgages we didn't get one. Now the beast has grown to ugly proportions and they're desperately trying to stave it off even longer and make it that much worse down the road.

The reason the business cycle/Fed are bad is because they are what cause great depressions; to their own admission, I might add.

"Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again."

And they're about to do it again.

Business cycles are bad for same reason why cocaine breakfasts are bad. You get an artificial high and then a major crash. The larger the high, the bigger the crash. It would be better to just have a stable economic system that existed within its means so we wouldn't have to have hyperinflationary economic collapses which see people go from middle class to homeless and eating boiled shoe leather on the corner.

…there's the rasengan, which is made even better in the manga and is a cutting tecnique it's very usefull against luffy.

also Naruto learns to cut things just by using he's chakara, I don't know wether he uses that in battle but I've seen it in the training.

then there's kage bunshin.. That doesn't always do much good, but it could be used. ofcourse he can also walk on water.. I don't know how that might help, but it's there.

I like both One Piece and Naruto, so I thought I'd chime in here.

First of all, I think we can all pretty much agree that kagebunshins would be mostly useless against Luffy as he would quickly turn them into clouds of smoke with gomu gomu no gatling gun/muchi/storm. Naruto's kagebunshins don't seem to last very long in any fights, so they definately wouldn't be a problem for a crowd control character like Luffy when he gets swarmed with 1-hitter quitters.

Using basic moves, I see Naruto losing easily. The only thing Naruto has in his arsenal that he can use normally which can hurt Luffy are sharp weapons and Rasengan. Naruto has the advantage in intelligence. For him to get a move off like Rasengan would require him to utilise ninja mind tricks with henge/kagebunshins like he did against Neji where he turned a shadow clone into a rock.

Now with both characters hulked out to their max, I believe Luffy would ultimately lose to the Kyubi. but under normal circumstances he shouldn't have too much problem against Naruto. Naruto doesn't know any Genjutsu, but it's strong against simple-minded people like Luffy so he'd definately have problems with illusionists.

Now the problem comes in when you start considering other characters. I see someone like Gaara easily taking out the Mugiwaras due to his bloodline limit. Then you have Akatsuki-level members like Orochimaru, Kisame, and Itachi which have insanely powerful moves like Tsukuyomi/Amaterasu/Edo Tensei, etc.

When we consider some of the upper-level One Piece characters, that's where it gets interesting. Ao Kiji could take out many Naruto characters without a problem by materializing right next to them and giving them an Ice Time before they have time to respond. I believe he could take out Naruto easily before he even had a chance to deploy his strong techniques/use Kyubi, etc. Kiji could probably kill Gaara just by attacking him and freezing his sand, rendering Gaara useless.

It would be interesting to see him fight someone like Itachi or Kakashi. Kiji doesn't seem too smart, so I can see him being outsmarted. Itachi could probably hit him with Tsukuyomi and kill him with psychological damage without having to physically destroy him, although he could likely accomplish that too with Amaterasu - although it is worth noting that using these moves drains Itachi quickly and also causes long-term damage to his vision the more often he uses them.

Kakashi, on the other hand, would have some major problems. If he hit him with Raikiri, he would just shatter into ice particles and reform - probably behind Kakashi for the freeze, but Kakashi is no chump and a big fan of Kawarimi, so I see a frozen log in his place. The only thing Kakashi has in his arsenal that I could see him use to potentially hurt Kiji would be Katon: Goukakyuu No Jutsu since it's a fire attack and ice is known not to stand up particularly well against those kinds of elements. Other than that, I don't see how he could do anything other than run.

People like Gai and Lee could beat Sanji, Nami, Usopp, and Chopper (not too sure about monster-point Chopper or Nico Robin, but with Hachimon Tonkou they should be able to take them down). I could see them having some problems with Usopp's tabasco boshis and things like those starting off, but they aren't anything that couldn't be overcome. They would have to use Hachimon Tonkou against Robin if they couldn't just use speed and knock her out quickly or she would just sprout hands all over them and clutch them to death. Opening the gates, they could power through her arms and move at blinding speed. Robin is a normal person outside her Devil Fruit ability, and a woman to boot, so I don't see her withstanding many hits from characters like them.

I liked the scene where Enel zaps Sanji and Sanji says "Thanks…. I needed a light". Fortunately 4Kids stopped dubbing, as that scene would have been ruined completely.

I also liked the scene at the end of Arabasta where they all say goodbye to Vivi by showing off their X marks.

Then there's that scene where Don Kreig comes in begging for food, everyone says he's going to backstab, Sanji gives him food, and he immediately clotheslines Sanji to the ground after eating and gives a little speech about piracy and that's how he rolls.

And who could forget Luffy vs. Crocodile. That was epic. Croc is one of the best villans evar.